As a Tradie, tools are the backbone of your daily operations, from hand tools to power equipment. Properly accounting for these purchases in QuickBooks Online (QBO) can help you track expenses, manage tax deductions, and maintain accurate financial records. The key is knowing when to classify a tool as an expense and when to treat it as a fixed asset.

How you track your tools directly impacts your bottom line. Correctly classifying these purchases ensures accurate tax filings and provides a clearer view of your business’s financial health.

In this guide, we'll walk you through the process of setting up accounts in QuickBooks Online for tool purchases and explain the accounting reasoning behind each decision, so you can manage your tools more effectively.

Expense vs Asset: The Core Accounting Principle

The first step in accounting for tools is determining whether to classify them as an expense or a fixed asset. This classification will impact your financial statements, cash flow, and tax liabilities. Here's how to differentiate:

Expense:

Tools that cost less than $300 should be categorized as expenses. You can claim the entire cost in the year you purchase them, which lowers your taxable income immediately. These tools are considered non-asset items because they tend to wear out quickly or provide short-term value.

Asset:

Tools costing $300 or more are classified as fixed assets. These tools provide value over several years and are depreciated over time, meaning you’ll deduct their cost gradually. This approach ensures their value is reflected on your balance sheet and helps manage taxable income over multiple years.

The $300 threshold exists because the Australian Tax Office (ATO) recognizes that smaller purchases don’t represent long-term investments. This figure is the current one found on the ATO site, at time of publishing this blog. The expense classification lets you take an immediate deduction, providing a quick tax benefit, but they won't contribute to the value of your business on the balance sheet. So if you are trying to value your business including tools that have been expensed or fully depreciated, you can add that figure to get a full picture of what your assets are worth.

Setting Up Tool Accounts in QuickBooks Online (QBO)

To get the most out of QuickBooks Online, you'll need to set up separate accounts for both tool expenses and fixed assets. This allows you to accurately track tool purchases, claim tax deductions, and maintain a clear picture of your financial health.

1. Create Accounts for Tools

You’ll start by creating the right accounts for your tools, ensuring that both small, everyday tools and larger, long-term investments are correctly categorized.

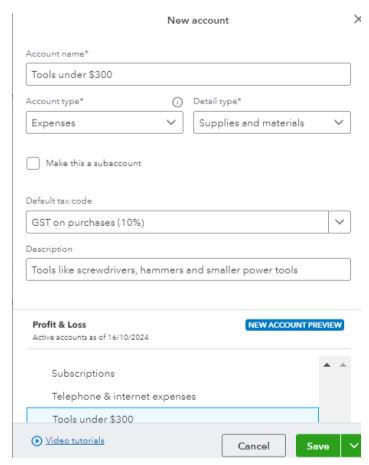

Expense Account for Tools Under $300:

Go to Chart of Accounts

Click New and create an account called Tools under $300. This account will be used for tools like screwdrivers, hammers, and smaller power tools that fall under the $300 threshold.

Fixed Asset Account for Tools Over $300:

In the same Chart of Accounts, create an account called Tools over $300 – Fixed Assets to specify tool purchases with Account Type as Fixed Assets and Detail Type as Machinery and Equipment.

Tools like generators, welders, or high-end power tools should be recorded here, as they will be depreciated over time.

2. Set Up Depreciation Accounts for Fixed Assets

Tools classified as fixed assets need to be depreciated, meaning their cost is spread over several years. QuickBooks Online (QBO) Plus creates two subaccounts for this asset: an account to track the cost and another to track depreciation. For other QBO versions, you may need to set up depreciation accounts manually:

Depreciation Expense Account:

Create an account called Depreciation Expense. This is where depreciation for each tool will be recorded annually. The value in this account will appear on your Profit and Loss statement, representing the portion of the tool’s value that has been "used up."

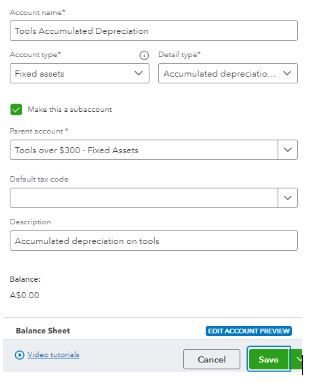

Accumulated Depreciation Account:

Set up an Accumulated Depreciation account under Fixed Assets. This is a contra-asset account that tracks how much depreciation has been applied to your tools over time. It reduces the overall value of your fixed assets on your balance sheet.

By setting up these accounts, you ensure that your financials accurately reflect the value of your tools and equipment as they age. When searching for tools in the Chart of Accounts, you should see:

An expense account for Tools under $300.

A Fixed Assets account for Tools over $300 (used when classifying the transaction/purchase).

An Accumulated Depreciation account for fixed assets tools.

A Tools Depreciation account (for the depreciation of those fixed assets).

Why Classification Matters: Tax Impact and Financial Reporting

The distinction between expense and asset classifications has a big impact on how your financials look and how much tax you pay. Here’s why getting this right is important:

Immediate Tax Deduction vs Long-Term Depreciation

Expense (Tools Under $300): When you classify tools as expenses, you can deduct their full cost in the year of purchase, immediately reducing your taxable income. This can provide a quick tax benefit but won’t contribute to the value of your business on the balance sheet.

Asset (Tools Over $300): For more expensive tools, capitalizing them as assets means you’ll depreciate their cost over time. This spreads the tax benefit over several years but ensures that the tools are reflected as long-term investments on your balance sheet, contributing to the overall value of your business.

Impact on Your Financial Statements

Tools classified as expenses only appear on your Profit and Loss statement, while capitalized tools show up on your balance sheet. This distinction matters for several reasons:

Business Valuation: When calculating the value of your business, tools classified as fixed assets will add to the total value. This is important if you’re applying for financing, selling your business, or producing financial statements for investors.

Tracking Long-Term Investments: Capitalizing larger tools as fixed assets helps you track their value over time and manage replacements when they reach the end of their useful life.

Let Your Accountant Handle Depreciation

While setting up your tool accounts in QuickBooks is crucial for day-to-day bookkeeping and set up by bookkeepers, the actual depreciation calculations are best handled by your accountant. Depreciation rules and tax incentives can change, and a knowledgeable accountant will ensure you’re getting the most out of your deductions.

A good accountant will either make the depreciation adjustments directly in QuickBooks or send instructions to your bookkeeper. It’s essential to keep your accountant involved in this process, as they’ll know about any new tax laws or incentives, such as the instant asset write-off or temporary full expensing, that can affect how you depreciate your tools.

Why Proper Setup Matters

Setting up your tool accounts in QuickBooks Online correctly is critical to managing your expenses, maximizing tax deductions, and maintaining accurate financial records. By categorizing tools based on their value, you can ensure your financial statements reflect both short-term expenses and long-term investments.

Classifying tools as either expenses (under $300) or fixed assets (over $300), ensures that you’re compliant with tax laws and can take advantage of tax deductions at the right time. And, as always, working with your accountant and bookkeeper on depreciation will help you stay on top of changing tax rules and incentives, ensuring you’re maximizing the financial benefits of your tool investments.

With QuickBooks Online set up properly, you’ll have clear visibility into your tools’ costs, a better understanding of your business’s financial health, and the tools to make informed decisions about future purchases.

Need help managing your books and getting everything set up in QuickBooks Online? Let Tradies Bookkeeping .Com handle the heavy lifting for you. We specialize in bookkeeping for tradies, ensuring your financials are accurate, tax-ready, and easy to understand. Reach out today to see how we can streamline your bookkeeping process, so you can focus on what you do best—getting the job done!

Comments